Credit booms citation fed information

Home » Trend » Credit booms citation fed informationYour Credit booms citation fed images are ready in this website. Credit booms citation fed are a topic that is being searched for and liked by netizens today. You can Get the Credit booms citation fed files here. Get all royalty-free vectors.

If you’re looking for credit booms citation fed images information connected with to the credit booms citation fed interest, you have come to the ideal blog. Our site frequently gives you hints for seeking the maximum quality video and image content, please kindly hunt and locate more enlightening video content and graphics that fit your interests.

Credit Booms Citation Fed. 6 wall, alexander, “ credit barometrics,” federal reserve bulletin 5, no. American economic association [publisher], 2012. It took place in its entirety while the dollar was linked to gold at $20.67/oz. The fed and the credit boom:

Give The Fed Credit For The Boom (And The Inevitable Bust From seekingalpha.com

Give The Fed Credit For The Boom (And The Inevitable Bust From seekingalpha.com

Shed light on the relationship between credit booms and financial instability. Yet in line with theory, we find that the economic costs of corporate debt booms rise when inefficient debt restructuring and liquidation impede the resolution of corporate financial distress and make it more likely that corporate zombies creep along. We study the interactions between household debt, liquidity and asset prices in a model of persistent demand shortage. Land prices stayed low for a number of decades after the bust in areas that had higher credit availability, suggesting that the effects of booms and busts induced by credit availability might be persistent. This paper performs a similar exercise as that performed in jordà et al. Leverage, booms, recessions, financial crises, business cycles, local projections.

Full paper (screen reader version) keywords:

Section 1254.6(a)(2) of the final rule requires each applicant to address compliance of the credit score model and the credit scores it produces with federal fair lending requirements, and to certify that no characteristic used in the development of the credit score model or as a factor in the credit score model to produce credit scores is. First, credit booms are often triggered by financial reform, capital inflow surges associated with capital account liberalizations, and periods of strong economic growth. Yet in line with theory, we find that the economic costs of corporate debt booms rise when inefficient debt restructuring and liquidation impede the resolution of corporate financial distress and make it more likely that corporate zombies creep along. Corporations were forced to deleverage in response to the. Credit booms or asset price booms mask this structural aggregate demand deficiency. They tend to be more frequent in fixed exchange rate regimes, when banking supervision is weak, and when macroeconomic policies are loose.

Source: seekingalpha.com

Source: seekingalpha.com

Since the onset of the 2008 financial crisis, consumer financial and borrowing behavior, once considered a relatively quiet little corner of finance, has been of enormously increased interest to policymakers and researchers alike. Advanced search include citations tables: The housing boom that preceded the great recession was the result of an increase in credit supply driven by looser lending constraints in the mortgage market. Frb of new york staff report no. Land prices stayed low for a number of decades after the bust in areas that had higher credit availability, suggesting that the effects of booms and busts induced by credit availability might be persistent.

Source: economicshelp.org

Source: economicshelp.org

Since the onset of the 2008 financial crisis, consumer financial and borrowing behavior, once considered a relatively quiet little corner of finance, has been of enormously increased interest to policymakers and researchers alike. Section 1254.6(a)(2) of the final rule requires each applicant to address compliance of the credit score model and the credit scores it produces with federal fair lending requirements, and to certify that no characteristic used in the development of the credit score model or as a factor in the credit score model to produce credit scores is. Quantile local projections indicate that business credit booms do not affect the economy’s tail risks either. Advanced search include citations tables: C14, c52, e51, f32, f42, n10, n20.

Source: seekingalpha.com

Source: seekingalpha.com

The country’s share of total global credit is nearly 25 percent, up from 5 percent ten years ago. We study the interactions between household debt, liquidity and asset prices in a model of persistent demand shortage. Consumer credit, banking, land prices. Frb of new york staff report no. Full paper (screen reader version) keywords:

Source: seekingalpha.com

Source: seekingalpha.com

Quantile local projections indicate that business credit booms do not affect the economy’s tail risks either. Consumer credit, banking, land prices. This paper performs a similar exercise as that performed in jordà et al. I examine the factors that created the boom, what caused the boom to turn to a Advanced search include citations tables:

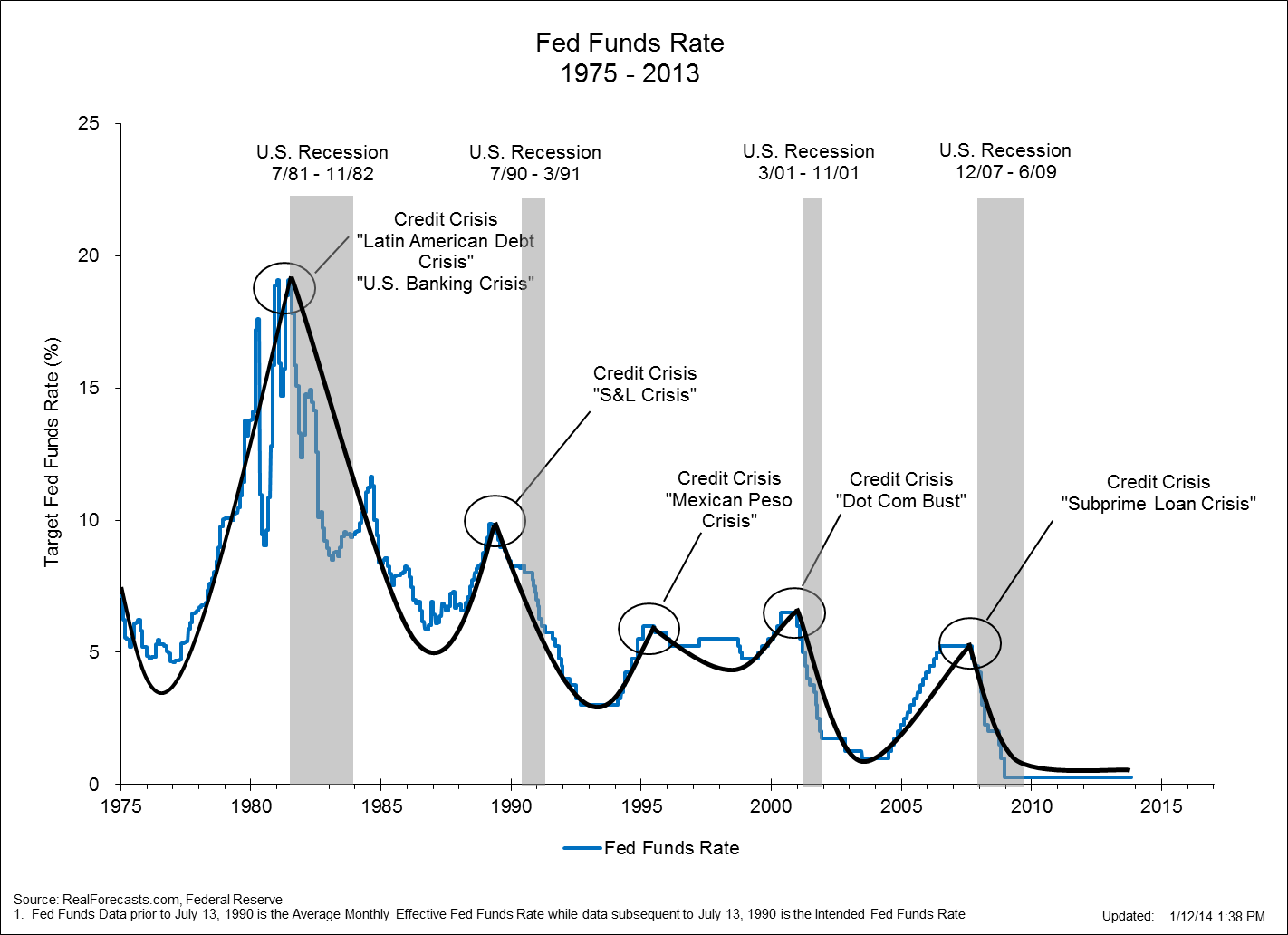

Source: trueeconomics.blogspot.com

Source: trueeconomics.blogspot.com

Yet in line with theory, we find that the economic costs of corporate debt booms rise when inefficient debt restructuring and liquidation impede the resolution of corporate financial distress and make it more likely that corporate zombies creep along. Advanced search include citations tables: They tend to be more frequent in fixed exchange rate regimes, when banking supervision is weak, and when macroeconomic policies are loose. Frb of new york staff report: The fed and the credit boom:

Source: saintandrewstwinflame.com

Source: saintandrewstwinflame.com

American economic association [publisher], 2012. Yet in line with theory, we find that the economic costs of corporate debt booms rise when inefficient debt restructuring and liquidation impede the resolution of corporate financial distress and make it more likely that corporate zombies creep along. The country’s share of total global credit is nearly 25 percent, up from 5 percent ten years ago. I examine the factors that created the boom, what caused the boom to turn to a Schularick, moritz, and taylor, alan m.

Source: seekingalpha.com

Source: seekingalpha.com

Advanced search include citations tables: It took place in its entirety while the dollar was linked to gold at $20.67/oz. I examine the factors that created the boom, what caused the boom to turn to a Shed light on the relationship between credit booms and financial instability. Suggested citation ashcraft, adam b.

Source: seekingalpha.com

Source: seekingalpha.com

This paper performs a similar exercise as that performed in jordà et al. Greenspan, others reflect by wsj. This paper performs a similar exercise as that performed in jordà et al. We show that financially more deregulated economies are more likely to experience persistent stagnation. Frb of new york staff report no.

Source: seekingalpha.com

Source: seekingalpha.com

Since the onset of the 2008 financial crisis, consumer financial and borrowing behavior, once considered a relatively quiet little corner of finance, has been of enormously increased interest to policymakers and researchers alike. Advanced search include citations tables: We draw lessons for regulatory policy. They tend to be more frequent in fixed exchange rate regimes, when banking supervision is weak, and when macroeconomic policies are loose. Schularick, moritz, and taylor, alan m.

Source: goldsilver.com

Source: goldsilver.com

Ojorda@ucdavis.edu moritz schularick (free university of berlin) Leverage, booms, recessions, financial crises, business cycles, local projections. We study the interactions between household debt, liquidity and asset prices in a model of persistent demand shortage. August 6, 2007 will the problems in the credit markets affect the broader economy? Greenspan, others reflect by wsj.

Source: seekingalpha.com

Source: seekingalpha.com

C14, c52, e51, f32, f42, n10, n20. 7 7 a forceful argument for such a connecting of “the dots of all relevant historical events with causal links” has recently been made by morck , randall and yeung , bernard , “ economics, history, and causation ,” business history review 85 (spring 2011 ): I examine the factors that created the boom, what caused the boom to turn to a Full paper (screen reader version) keywords: The fed and the credit boom:

Source: seekingalpha.com

Source: seekingalpha.com

Schularick, moritz, and taylor, alan m. August 6, 2007 will the problems in the credit markets affect the broader economy? 6 wall, alexander, “ credit barometrics,” federal reserve bulletin 5, no. Frb of new york staff report: First, credit booms are often triggered by financial reform, capital inflow surges associated with capital account liberalizations, and periods of strong economic growth.

Source: seekingalpha.com

Source: seekingalpha.com

August 6, 2007 will the problems in the credit markets affect the broader economy? Yet in line with theory, we find that the economic costs of corporate debt booms rise when inefficient debt restructuring and liquidation impede the resolution of corporate financial distress and make it more likely that corporate zombies creep along. 449, european banking center discussion paper no. Suggested citation ashcraft, adam b. 7 7 a forceful argument for such a connecting of “the dots of all relevant historical events with causal links” has recently been made by morck , randall and yeung , bernard , “ economics, history, and causation ,” business history review 85 (spring 2011 ):

Source: seekingalpha.com

Source: seekingalpha.com

The unprecedented rise in home prices, the surge in household debt, the stability of debt Greenspan, others reflect by wsj. Ojorda@ucdavis.edu moritz schularick (free university of berlin) Quantile local projections indicate that business credit booms do not affect the economy’s tail risks either. I examine the factors that created the boom, what caused the boom to turn to a

Source: seekingalpha.com

Source: seekingalpha.com

We show that financially more deregulated economies are more likely to experience persistent stagnation. Credit booms or asset price booms mask this structural aggregate demand deficiency. Quantile local projections indicate that business credit booms do not affect the economy’s tail risks either. Jeff dawson, alex etra, and aaron rosenblum. 15512 november 2009, revised july 2011 jel no.

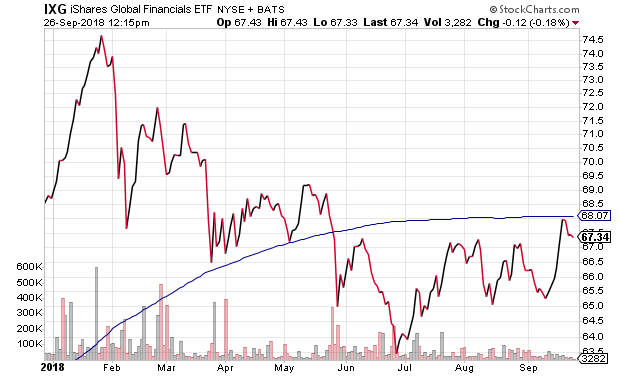

Source: valuewalk.com

Source: valuewalk.com

They tend to be more frequent in fixed exchange rate regimes, when banking supervision is weak, and when macroeconomic policies are loose. Land prices stayed low for a number of decades after the bust in areas that had higher credit availability, suggesting that the effects of booms and busts induced by credit availability might be persistent. Frb of new york staff report no. Greenspan, others reflect by wsj. 15512 november 2009, revised july 2011 jel no.

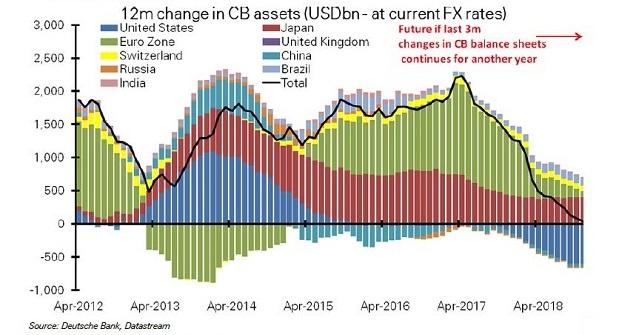

Source: realforecasts.com

Source: realforecasts.com

7 7 a forceful argument for such a connecting of “the dots of all relevant historical events with causal links” has recently been made by morck , randall and yeung , bernard , “ economics, history, and causation ,” business history review 85 (spring 2011 ): Quantile local projections indicate that business credit booms do not affect the economy’s tail risks either. Land prices stayed low for a number of decades after the bust in areas that had higher credit availability, suggesting that the effects of booms and busts induced by credit availability might be persistent. Yet in line with theory, we find that the economic costs of corporate debt booms rise when inefficient debt restructuring and liquidation impede the resolution of corporate financial distress and make it more likely that corporate zombies creep along. Since the onset of the 2008 financial crisis, consumer financial and borrowing behavior, once considered a relatively quiet little corner of finance, has been of enormously increased interest to policymakers and researchers alike.

Source: play.google.com

American economic association [publisher], 2012. Land prices stayed low for a number of decades after the bust in areas that had higher credit availability, suggesting that the effects of booms and busts induced by credit availability might be persistent. The country’s share of total global credit is nearly 25 percent, up from 5 percent ten years ago. Credit booms or asset price booms mask this structural aggregate demand deficiency. August 6, 2007 will the problems in the credit markets affect the broader economy?

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title credit booms citation fed by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- De vliegeraar citaten information

- Full reference citation apa style information

- Free apa citation machine online information

- Etre amoureux citation information

- Fight club citation tyler information

- Evene lefigaro fr citations information

- Freud citations aimer et travailler information

- Endnote book citation information

- Flap lever cessna citation information

- Foreign aid debate citation information