Does value leverage pay off citation information

Home » Trending » Does value leverage pay off citation informationYour Does value leverage pay off citation images are available in this site. Does value leverage pay off citation are a topic that is being searched for and liked by netizens now. You can Get the Does value leverage pay off citation files here. Get all free images.

If you’re searching for does value leverage pay off citation pictures information connected with to the does value leverage pay off citation keyword, you have visit the ideal blog. Our website frequently provides you with suggestions for seeing the maximum quality video and image content, please kindly search and locate more enlightening video content and graphics that fit your interests.

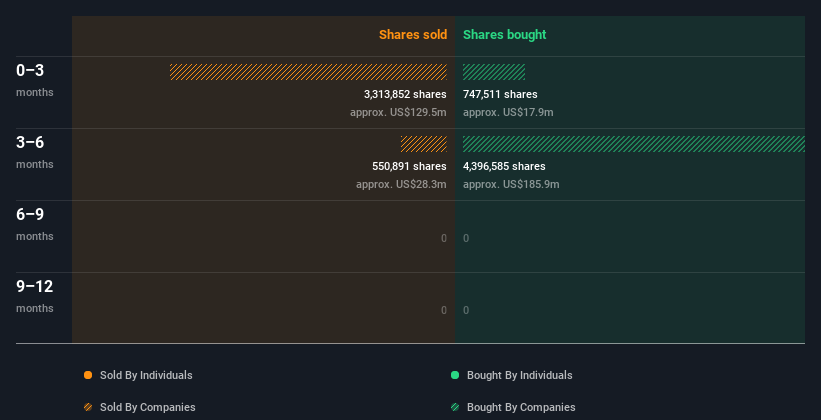

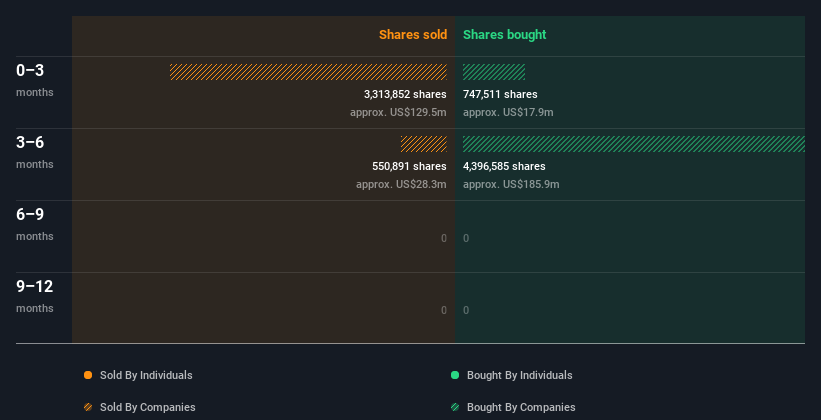

Does Value Leverage Pay Off Citation. = $20 / $5 = 4.00x That 10% growth became 100% profit on your initial investment! Borrows as much as they can from a variety of lenders (up to 70 or 80 percent of the purchase price) and funds the balance with their own. Return = leverage ratio * percent change

The perpetual real option’s value is the contingent claim’s value times the net debt benefit at the threshold: Commonly used by credit agencies, this ratio determines the probability of defaulting on issued debt. These transactions typically occur when a private equity (pe) firm. 1) paying down a mortgage increases the equity you have in a property. In the stock market, you pay 100% of your money to control 100% of your investments. The buyout portion refers to the fact that the method is often used to transform a publicly held company into one that is privately held.

The term leveraged refers to the use of debt as the primary method of financing the restructuring.

A leverage ratio is a financial ratio that helps to measure a company’s debt levels. We use the notation s* to denote the immediate predecessor of s. I see you also have some thoughts about the current cape and equity valuations. The term leveraged refers to the use of debt as the primary method of financing the restructuring. The financial leverage is considered as second stage leverage because it is dependant upon the degree of operating leverage. Because the purchase is debt driven, an lbo can give your company some tax advantages.

Source: kidnowism.blogspot.com

Source: kidnowism.blogspot.com

If the acquisition tanks after the purchase and can�t pay off the debt, your company and personal finances are safe. The state space is now s = {0, u, d, uu, ud, du, dd}. The company performing the lbo or takeover only has to provide a portion of the financing yet is able to make a large purchase through the use of debt,. Lbo stands for leveraged buyout and refers to the purchase of a company while using mainly debt to finance the transaction. At first blush we’d say 10%, which is true — but you made 10% on the entire 100k!

There are a number of reasons why this type of transaction might take place. I see you also have some thoughts about the current cape and equity valuations. But now suppose the asset y pays off after two periods instead of one period. If the acquisition tanks after the purchase and can�t pay off the debt, your company and personal finances are safe. Return = leverage ratio * percent change

Source: okedesign.github.io

Source: okedesign.github.io

Leverage is using other people’s money to make money for you. A leverage ratio is a financial ratio that helps to measure a company’s debt levels. It seems to me hard to believe strongly in both ideas at the same time (high valuation, leveraged equity investments). Only with two pieces of bad news does the asset pay.2. Simply put, it captures all debts/liabilities regardless of their listing.

Source: okedesign.github.io

Source: okedesign.github.io

Commonly used by credit agencies, this ratio determines the probability of defaulting on issued debt. Only with two pieces of bad news does the asset pay.2. There are a number of reasons why this type of transaction might take place. The leverage ratio is defined as the number of dollars being borrowed for each dollar being invested. The perpetual real option’s value is the contingent claim’s value times the net debt benefit at the threshold:

Source: researchgate.net

Source: researchgate.net

As a backstop measure, the leverage ratio is the proportion of equity to assets. A leverage ratio is a financial ratio that helps to measure a company’s debt levels. This happens because the personal tax rate on interest is Simply put, it captures all debts/liabilities regardless of their listing. = $20 / $5 = 4.00x

Source: dlecourse.com

Source: dlecourse.com

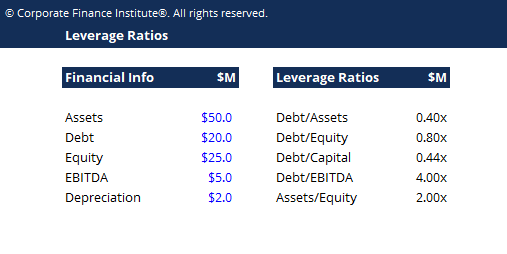

The more leverage you have, the higher your return on investment. The most direct way for an entity to deleverage is to immediately pay off any existing debts and obligations on its balance sheet. That 10% growth became 100% profit on your initial investment! The value of the investment will be $1840 at the end of the year and you will pay the bank back $1500 + $90 = $1590, leaving you with a total of $250 and a net gain of $150 once you subtract the initial $100 you invested. Lbo stands for leveraged buyout and refers to the purchase of a company while using mainly debt to finance the transaction.

Source: esgconsultingbiz.com

Source: esgconsultingbiz.com

Leverage ratio = asset / equity; Essentially, the net debt to ebitda ratio (debt/ebitda) gives an indication as to how long a company would need to operate at its current level to pay off all its debt. Return = leverage ratio * percent change Financial leverage is more about the borrowings from external sources and needs to be repaid sooner or later. When the mortgage is paid off, hopefully the valuations will be better and i can make much larger contributions with the former mortgage payment money.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

Only with two pieces of bad news does the asset pay.2. This class of model treats the common stock of levered firms as a claim (option) on the value of the firm as a whole that can be exercised by paying off the bondholders. If the acquisition tanks after the purchase and can�t pay off the debt, your company and personal finances are safe. We have successfully closed leveraged esop transactions for companies in manufacturing (apparel, electronics, consumer goods), distribution, transportation, construction, automobile dealerships, as well as professional organizations such as architecture and engineering firms, physician practices and other service providers that once were unlikely candidates. Leverage is using other people’s money to make money for you.

Source: gogoaffiliate.com

Source: gogoaffiliate.com

Leverage, asymmetric information, firm value, and cash holdings in indonesia abstract this research aimed to analyze the effect of leverage and asymmetry information on the firm value through cash holding as mediation variable. Lbo stands for leveraged buyout and refers to the purchase of a company while using mainly debt to finance the transaction. Financial leverage is more about the borrowings from external sources and needs to be repaid sooner or later. The company performing the lbo or takeover only has to provide a portion of the financing yet is able to make a large purchase through the use of debt,. This class of model treats the common stock of levered firms as a claim (option) on the value of the firm as a whole that can be exercised by paying off the bondholders.

Source: thepointsguy.com

Source: thepointsguy.com

In real estate, you pay 20% of your money to control 100% of a property. Lbo (leveraged buyout) analysis helps in determining the maximum value that a financial buyer could pay for the target company and the amount of debt that needs to be raised along with financial considerations like the present and future free cash flows of the target company, equity investors required hurdle rates and interest rates, financing structure and banking agreements. It is a measurement that determines a company’s sustainability towards its borrowing practices. = $20 / $5 = 4.00x In corporate finance, a leveraged buyout (lbo) is a transaction where a company is acquired using debt as the main source of consideration.

Source: usermanual.wiki

Source: usermanual.wiki

This happens because the personal tax rate on interest is In real estate, you pay 20% of your money to control 100% of a property. 1) paying down a mortgage increases the equity you have in a property. That 10% growth became 100% profit on your initial investment! Essentially, the net debt to ebitda ratio (debt/ebitda) gives an indication as to how long a company would need to operate at its current level to pay off all its debt.

Source: myspotifyglass.co.uk

Source: myspotifyglass.co.uk

In the stock market, you pay 100% of your money to control 100% of your investments. While there is a large number of these models, attention is largely limited here to the one studied by black and cox (1976) since it lends itself to straightforward interpretations. In this case, vl < vu. (3) w (ν) = d b (ν i) (ν ν i) β 1 ν ≤ ν i, d b (ν) = t s (ν) − d c (ν), β 1 = h 2 + 2 r − h σ, h = r − δ − (1 2 σ 2) σ where db is the present value of net debt benefit, ts is the present value of tax savings, dc is the present value of debt costs, and w is the present value of the. This happens because the personal tax rate on interest is

Source: new.podtail.com

Source: new.podtail.com

At first blush we’d say 10%, which is true — but you made 10% on the entire 100k! In the stock market, you pay 100% of your money to control 100% of your investments. At first blush we’d say 10%, which is true — but you made 10% on the entire 100k! Paying off the mortgage early reverses the benefit of the leverage you got in the first place. As a backstop measure, the leverage ratio is the proportion of equity to assets.

Source: kidnowism.blogspot.com

The most direct way for an entity to deleverage is to immediately pay off any existing debts and obligations on its balance sheet. To understand more about financial leverage, let us go through the following factors: If the acquisition tanks after the purchase and can�t pay off the debt, your company and personal finances are safe. The most direct way for an entity to deleverage is to immediately pay off any existing debts and obligations on its balance sheet. The buyout portion refers to the fact that the method is often used to transform a publicly held company into one that is privately held.

Source: okedesign.github.io

Source: okedesign.github.io

In corporate finance, a leveraged buyout (lbo) is a transaction where a company is acquired using debt as the main source of consideration. In other words, the value of the levered firm is equal to the value of the unlevered firm. It is a measurement that determines a company’s sustainability towards its borrowing practices. Leverage ratio = asset / equity; Leverage is using other people’s money to make money for you.

Source: esgconsultingbiz.com

Source: esgconsultingbiz.com

Because the purchase is debt driven, an lbo can give your company some tax advantages. We demonstrated that above by showing why you might rather leverage than not leverage your initial purchase. This happens because the personal tax rate on interest is The house is now worth 110k, and after paying your 90k debt you’re left with 20k. We have successfully closed leveraged esop transactions for companies in manufacturing (apparel, electronics, consumer goods), distribution, transportation, construction, automobile dealerships, as well as professional organizations such as architecture and engineering firms, physician practices and other service providers that once were unlikely candidates.

Source: vertex42.com

Source: vertex42.com

Paying off the mortgage early reverses the benefit of the leverage you got in the first place. Debt/ebitda debt/ebitda ratio the net debt to earnings before interest, taxes, depreciation, and amortization (ebitda) ratio measures financial leverage and a company’s ability to pay off its debt. In real estate, you pay 20% of your money to control 100% of a property. There are a number of reasons why this type of transaction might take place. The leverage ratio is defined as the number of dollars being borrowed for each dollar being invested.

Source: cowboystatedaily.com

Source: cowboystatedaily.com

While there is a large number of these models, attention is largely limited here to the one studied by black and cox (1976) since it lends itself to straightforward interpretations. When you purchase a house with a mortgage, you are using leverage to buy property. Leverage ratio = asset / equity; At first blush we’d say 10%, which is true — but you made 10% on the entire 100k! Only with two pieces of bad news does the asset pay.2.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title does value leverage pay off citation by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Easybib chicago citation information

- Doi to apa citation machine information

- Citation x poh information

- Cpl kyle carpenter medal of honor citation information

- Goethe citation dieu information

- Exact citation apa information

- Citation une impatience information

- Fitzgerald way out there blue citation information

- Contre le racisme citation information

- Friedrich nietzsche citaat grot information